5 percent mortgage calculator

The mortgage points calculator will help you to calculate whether or not it is going to be beneficial for you to buy mortgage points or not. You will get a comparison table that compares your original mortgage with the early payoff.

Interest Only Mortgage Calculator

Freddie Mac During that time youll pay 200000 in principal plus another 125325 in interest for a total 325325.

. But to compensate for the low. The purpose of the insurance is to protect the lender if you default on the note. The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment.

You can use a mortgage calculator to help you to find out this information specific to your current loan. Mortgage rates are typically priced in steps of one-eighth of a percent like 45 4625 475 4875 percent etc but the actual pricing is more precise. The 56 adjustable-rate mortgage ARM ticked up to 508 percent from 5 percent a week ago.

Rather than something like 4813 percent. However as a drawback expect it to come with a much higher interest rate. The 15-year fixed-rate mortgage was 503 percent up from 497 percent last week.

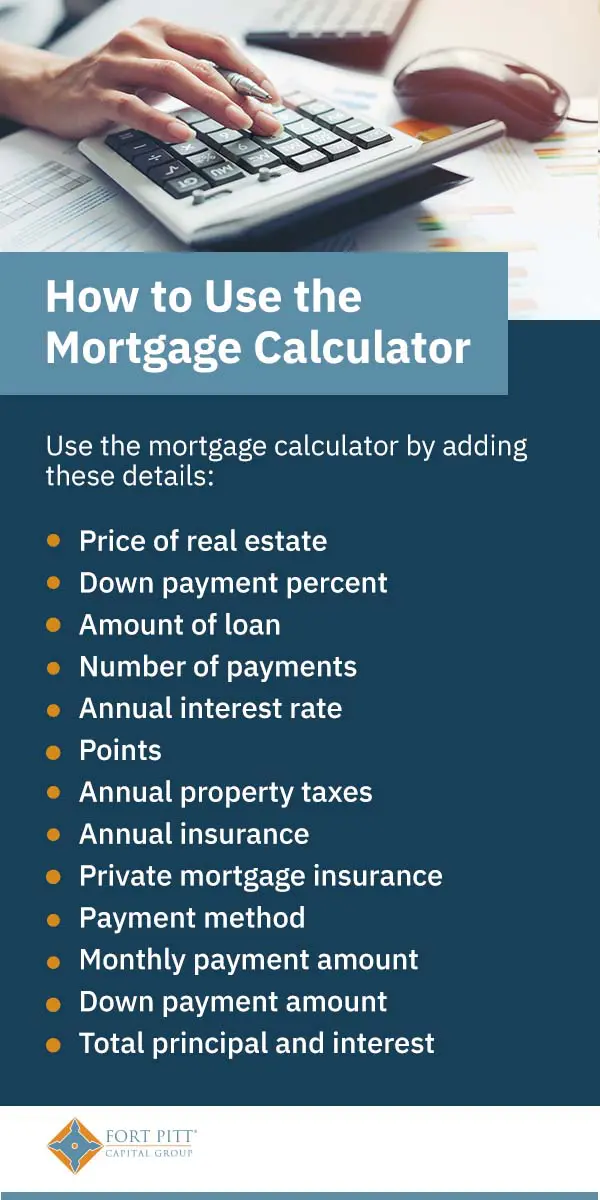

This mortgage calculator is intended to assist you with estimating basic. It also computes your total mortgage payment inclusive of property tax property insurance and PMI payments monthly PITI payments. Before going under contract on a home spend some time with a mortgage calculator experimenting with different mortgage terms.

This mortgage finances the entire propertys cost which makes an appealing option. If you cant afford the payment on a 10-year or 15-year mortgage consider going with a 20-year or 30-year. These are also the basic components of a mortgage.

Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. 30 years Monthly payment. When you compare that to a 30-year fixed loan at 35 percent the cost would be about 900 per month.

Take a look at the following example. The AARP mortgage calculator can help you do just that. PMI typically costs between 05 and 1 of the entire loan amount.

Enter the interest rate of your home loan in percent step 2 of 5-- Continue to step 3. How can a mortgage calculator help me. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages.

Why should I pay off my mortgage early. NACAs Housing Counselors work with members to prepare them for homeownership including determining an affordable mortgage payment consisting of the principal interest taxes insurance and HOA. Bankrates mortgage amortization calculator shows how even a 01 percent difference on your rate can translate to thousands of dollars you could have to pay out over the life of the loan.

35 percent of the homes value. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. If inflation rises at 4 percent annually and your mortgage stays at 3 percent youve got a pretty good deal.

Escrow homeowners insurance property taxes insurances HOA fees and other costs associated with owning a home. You will not be charged any extra. This is the best option if you are in a rush andor only plan on using the calculator today.

The Mortgage Calculator is crucial in determining the mortgage amount based on an affordable monthly mortgage payment. This is the best option if you plan on using the calculator many times over the. Use this free tool to compare fixed rates side by side against variable rate mortgages and interest-only home loans.

The 45 rate would only apply to peope buying homes not refinancing. Mortgages are how most people are able to own homes in the US. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate.

The 30-year fixed-rate. A mortgage usually includes the following key components. The government will loan you up to 20 percent of the total cost of your home so youll need a 5 percent cash deposit and a mortgage to cover the final 75 percent.

What is the loan term--Select the loan term step 3 of 5. Mortgage Early Payoff Calculator excel to calculate early mortgage payoff and total interest savings by paying off your mortgage early. This tool assumes that private mortgage insurance PMI is required if you are making a down payment of less than 20 percent of the homes purchase price.

Mortgage Calculator zip file - download the zip file extract it and install it on your computer. While the maximum affordable mortgage. 4875 Mortgage Calc 4 Mortgage Payment Calculator 399 Mortgage Payment Calculator 35 Mortgage Payment Calc and Amortization table 30 Mortgage Payment Calculator and Amortization Table 299 Mortgage Payment Calculator and Amortization Table.

Mortgage Calculator Estimate Your Monthly Payments

Interest Only Arm Calculator Estimate 2 1 3 1 5 1 7 1 10 1 Io Monthly Mortgage Payments

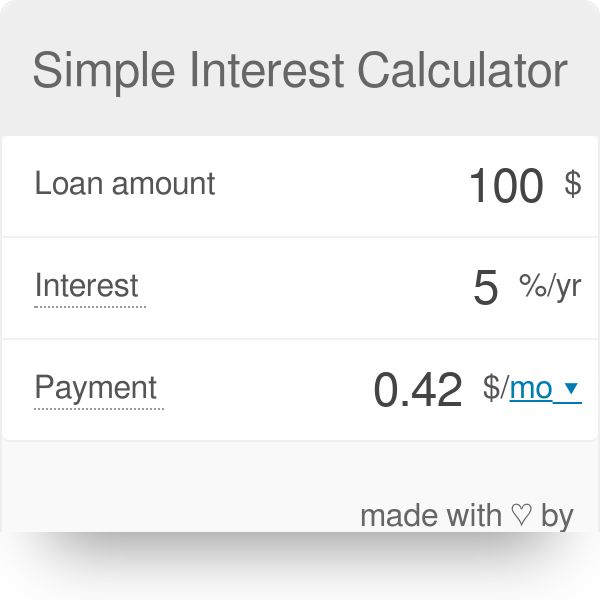

Simple Interest Calculator Defintion Formula

Mortgage Calculator With Down Payment Dates And Points

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

How Much A 400 000 Mortgage Will Cost You Credible

Va Mortgage Calculator Calculate Va Loan Payments

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

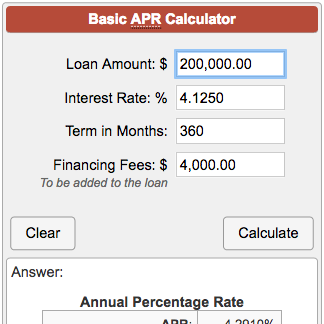

Basic Apr Calculator

Discount Points Calculator How To Calculate Mortgage Points

Online Mortgage Calculator Wolfram Alpha

Simple Loan Calculator

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator Estimate Your Monthly Payments